Managing corporate travel expenses efficiently is a constant challenge for travel managers. One of SAP Concur’s most powerful features is its audit rules functionality. In this article, we’ll explore how audit rules can transform your expense management process and help you maintain compliance while saving valuable time and resources.

Why Audit Rules Matter in SAP Concur

Travel managers know the pain of manually reviewing hundreds of expense reports for policy violations and errors. SAP Concur’s audit rules act as your first line of defense, automatically flagging potential issues before they reach your desk. These automated checks ensure consistency in expense report reviews and significantly reduce the time spent on manual verification.

Beyond simple error catching, audit rules serve as an educational tool for employees. When travelers receive immediate feedback about policy violations, they learn to submit compliant expenses from the start. This proactive approach leads to fewer corrections and re-submissions, streamlining the entire expense management process.

SAP Concur offers two levels of audit rules: red and yellow. Red audit rules act as hard stops – employees cannot submit their expense reports until they resolve these violations. This makes them perfect for enforcing critical policies like missing required receipts or exceeded spending limits. Yellow audit rules, on the other hand, serve as warnings/tips. While they flag potential policy violations, employees can still submit their reports. This flexibility is particularly useful for exceptions that require explanation rather than correction, such as late submissions or unusual merchant categories. The combination of both rule types allows you to balance strict compliance requirements with business flexibility.

Key Benefits of Implementing Robust Audit Rules

The strategic implementation of audit rules delivers multiple advantages for your organization:

- Risk Mitigation: By automatically flagging unusual spending patterns or policy violations, audit rules help prevent fraud and ensure regulatory compliance. They create a consistent control environment that auditors appreciate during reviews.

- Cost Savings: While expenses are typically flagged after they’ve occurred, audit rules help identify non-compliant spending before reimbursement or approval of the expense. This allows you to address policy violations promptly, coach employees on proper expense practices, and prevent similar out-of-policy spending in the future. The immediate feedback loop created by audit rules leads to better spending behavior over time, ultimately reducing non-compliant expenses.

- Efficiency Gains: With automated checks handling routine verifications, your team can focus on strategic tasks rather than manual review work. This time savings translates directly into increased productivity and better resource allocation. You can even make use of audit rules to define auto-approved expense reports within your parameters.

Best Practices for Creating Effective Audit Rules

When setting up audit rules, remember that less is often more. While it’s tempting to create rules for every possible scenario, an overwhelming number of checks can lead to alert fatigue – where users become desensitized to warnings and start ignoring them altogether. This is also true for managers approving the expense reports, as yellow audit rules will be shown to them and they might end up confused by too many warnings. Focus on creating meaningful rules that address your most important policy requirements and compliance needs. A carefully curated set of audit rules will be more effective than a lengthy list that users rush through without reading.

To maximize the benefits of SAP Concur audit rules, consider these proven strategies:

- Start with Clear Policy Definitions: Before creating audit rules, ensure your travel and expense policies are clearly defined. Well-documented policies make it easier to translate requirements into effective rules.

- Layer Rules Strategically: Begin with fundamental checks and gradually add complexity. For example, start with basic receipt requirements and spending limits, then add rules for specific expense types or special approval workflows.

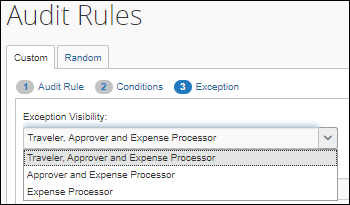

- Use Exception Handling Wisely: While strict rules are important, build in reasonable exceptions to accommodate legitimate business needs. For instance, you might allow higher meal expenses in specific cities or during customer meetings.

- Leverage Data Analytics: Regularly analyze rule violation patterns to identify areas where policy education might be needed or where rules might need adjustment. This data-driven approach helps you fine-tune your audit rules over time.

Advanced Tips for Audit Rule Configuration

To take your audit rules to the next level, consider implementing these advanced features:

- Conditional Logic: Create sophisticated rules that consider multiple factors. For example, trigger additional approvals when expenses exceed certain thresholds AND involve specific expense types or locations. The general rule is: as long as the data is available you can use it as a condition for the audit rules (with exceptions, of course).

- Custom Fields: Utilize custom fields to capture additional information needed for complex policy enforcement. This might include project codes, client information, or special approval requirements.

- Integration Rules: If you’re using other enterprise systems, create rules that validate data against these external sources. This ensures consistency across your technology ecosystem.

Maintaining and Evolving Your Audit Rules

Success with audit rules requires ongoing attention and refinement. Schedule regular reviews of your rule set to ensure it remains aligned with current policies and business needs. Pay attention to user feedback and violation patterns to identify opportunities for improvement.

Consider creating a change management process for audit rules. Document all rule modifications and communicate changes to affected employees. This transparency helps maintain user trust and ensures smooth policy implementation.

SAP Concur’s audit rules are more than just a compliance tool – they’re a powerful ally in creating an efficient, cost-effective travel management program. By thoughtfully implementing and maintaining these rules, you can significantly reduce manual review work while ensuring policy compliance. Remember that the most effective audit rules balance control with usability. Start with clear policies, implement rules strategically, and continuously refine your approach based on real-world results.

Still struggling with setting up your audit rules or looking to make the most out of your SAP Concur implementation? Let’s talk about how I can help you create an efficient and user-friendly expense management process that works for your company.